Disclaimer: I am not an accountant nor practicing the field. The information I’ll provide to register as a freelancer is based on my pure experience and research. If you have other tax-related questions, I recommend you to join the Freelancers BIR Tax Compliance Support Group on Facebook. The admin and his team are really friendly and they answer questions about tax filing for free.

According to the BIR, self-employed professionals are those who practice their profession and make personal income from it, whether or not they obtain a license from a government entity. As a result of the new digital models for freelancing labor and revenue, the BIR has intensified its review of its clear standards for various self-employed tax situations. The primary requirements for tax exemption are as follows:

- A minimum wage earner

- Gross income is significantly below Basic Personal Exemption (Php 50,000, regardless of marital status) and Additional Personal Exemption (₱25,000 per child dependent with a maximum of 4)

- The annual salary from your employer is ₱60,000 and below.

We are not required to pay tax if we qualify for one of these exemptions. Otherwise, we’ll be required to comply. The Bureau of Internal Revenue (BIR) classifies freelancers into two categories when it comes to taxation in the Philippines: workers and business owners. Currently, the BIR does not have a separate category for solely freelance labor. Freelancers are classified as self-employed professionals in general under BIR standards.

- practicing a profession and registered under the Professional Regulation Commission (PRC) such as doctors, dentists, public accountants, etc.

- practicing a profession that doesn’t require a PRC license as a means of personal income (including freelance and home-based work) such as writers, athletes, designers, etc.

How to Register as a Freelancer on BIR

Another disclaimer: The process I took is applicable on RDO 17-A and I transitioned from employed to self-employed. If you are on a different tax type (e.g. mixed-income earner, etc.), please ask your questions on the Facebook Group I recommended.

Update your TIN

It is really simple to register as a freelancer on BIR. If you already have a TIN from your employer, you need to update your TIN first. Otherwise, get a new one. To register as a freelancer, fill out the BIR Form 1905 to change your status from employee to self-employed. However, if you’re employed and work part-time as a freelancer, you can register as a mixed-income earner.

Situation: When I was previously employed, my TIN’s RDO was in RDO 43. Before you may register as a self-employed freelancer, you must first transfer your TIN from the previous RDO to the present RDO. So I sent them an email, and they informed me of the process. Previously, you had to go to the previous RDO on your own to request a TIN transfer. However, thanks to their new IRIS system, it is now possible to transfer TIN from the previous RDO to the current RDO without having to physically visit the former RDO – as long as the change in status is from employed to self-employed. Transferring a business TIN to a new RDO will be a separate process.

Prepare the requirements

Some RDOs ask for additional requirements on top of the CDR as proof that you are indeed working as a freelancer. They may ask such as Occupational Tax Receipt, a contract, cedula, etc. So before preparing the requirements, ask your current RDO what documents they would need to register as a freelancer on BIR.

However, In RDO 17-A (my current RDO), they follow the official Checklist of Documentary Requirements that BIR released recently as a standard.

The requirements I prepared are the following:

- Tax Identification Number (TIN)

- 2 Copies of BIR 1901 version 2018 form

- 2 Copies of BIR 1905 form (for updating TIN)

- 3 Copies of Payment 0605 form (which will be generated thru eBIRForms Offline Package)

- 500 PHP registration fee and 30 PHP for documentary stamp

- Any valid government-issued ID that shows the name, address, and birthdate of the applicant

In my case, I provided my Postal ID. That’s the easiest ID that I can get on my married name.

There is more information on what requirements freelancers usually need to comply with in the book The Ultimate DIY BIR Tax Compliance Guide for Freelancers 2022 Edition.

Pay the Registration Fee

You can pay the registration fee of ₱500.00 at the BIR counter or lessen the hassle by paying in advance via GCash, Bank, or PayMaya. I paid the fee using GCash. You can follow the steps on how to do so on The Ultimate DIY BIR Tax Compliance Guide for Freelancers 2022 Edition.

Book an Appointment In Advance

As a result of the current system modifications, BIR has improved in terms of supporting individuals. People can now either walk in or set an appointment for their BIR transaction. It is strongly encouraged to book an appointment in advance because persons with e-BIR appointments are given priority over walk-in guests. You will save time because you will not have to wait in line.

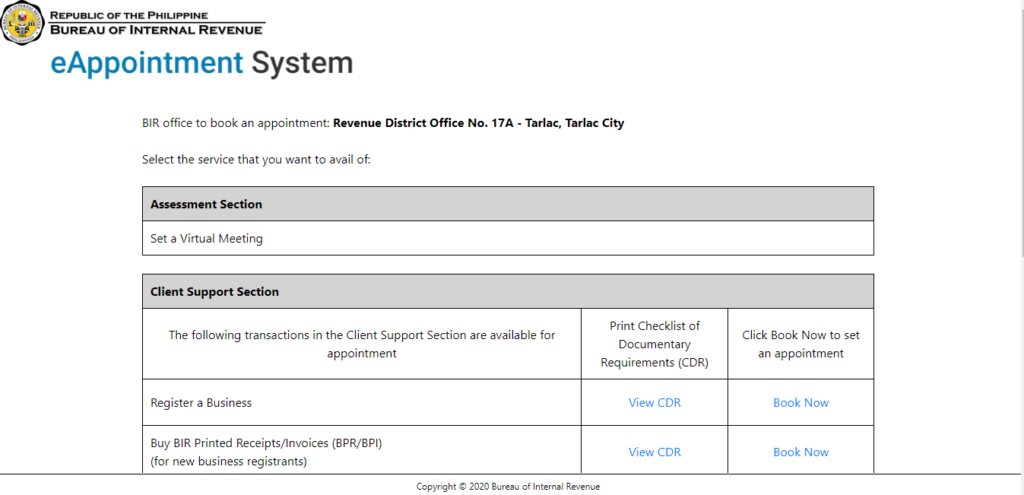

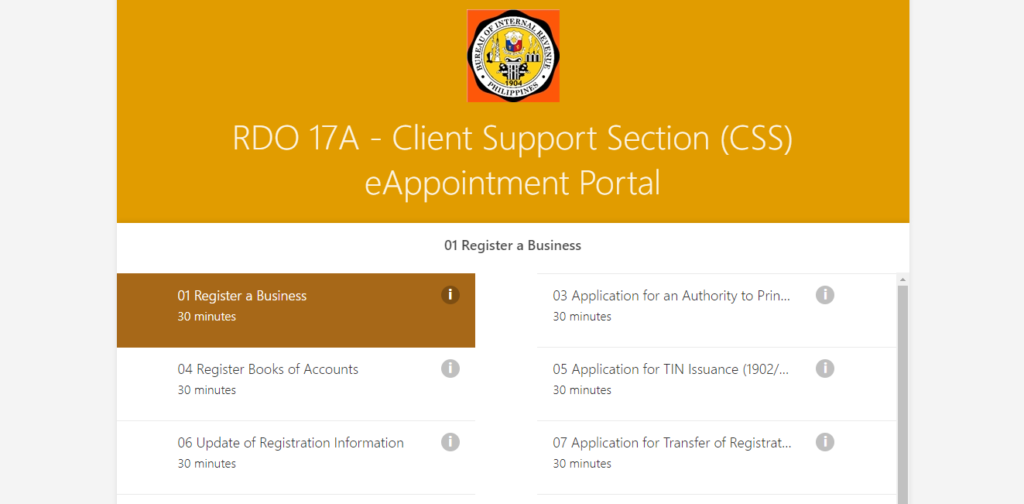

Book an appointment through e-BIR Appointment and look for your respective RDO. After you select your RDO, choose a service that you want to transact with BIR. Then, accept the e-BIR Appointment User Agreement then proceed with selecting the schedule that works for you.

Submit all the requirements

To avoid the hassle of going back and forth, complete the requirements prior to your appointment. Because I reserved ahead of time, I received priority treatment. My appointment is on the 31st of January, 2022. I came 15 minutes early for my appointment since people who are late for their appointments would no longer be prioritized and will be put back in the walk-in queue.

Then I went to the officer-in-charge, who double-checked that all of my requirements had been met. She then handed my documents to the lady behind counter number 2, who registered my business with the information I had provided. Also, I informed her that as a freelancer, I opted for the 2018 TRAIN Law where my Income Tax rate would be 8% of the gross and I am registering as a Non-VAT taxpayer.

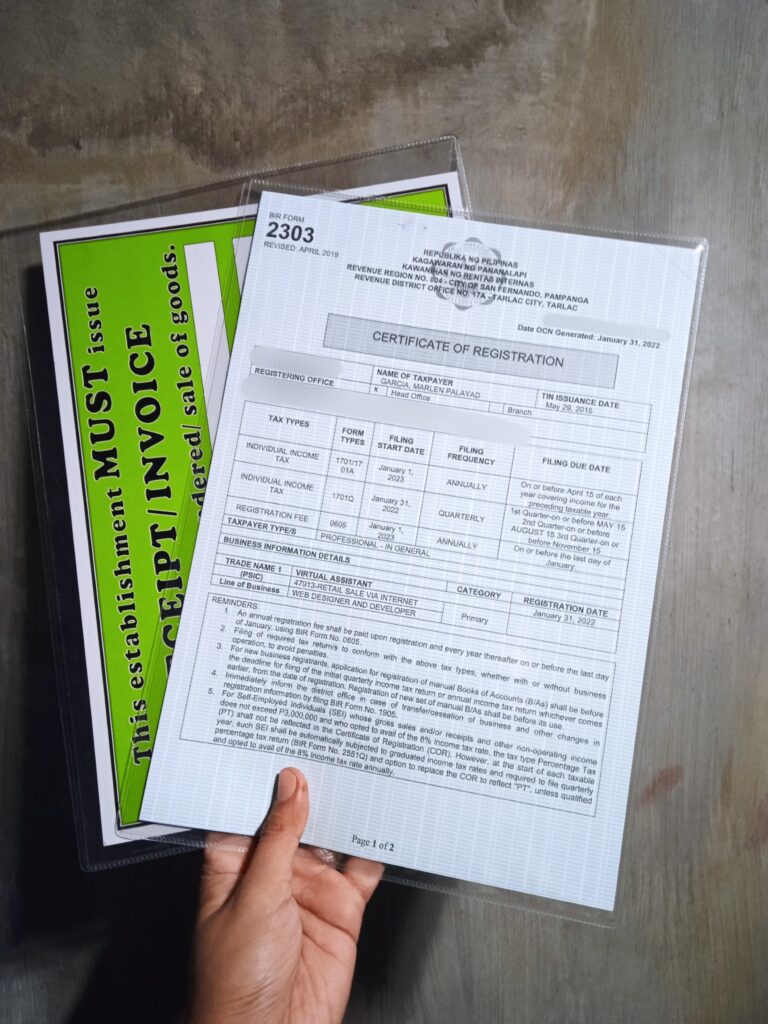

She processed everything according to my info and preferences. Later that day, I received my Certificate of Registration, Form 1906 for receipt printing, and a green sign for using and providing a receipt.

Note: After receiving your Authority to Print, you must print the official receipts within thirty days, or you will be required to obtain ATP again from the BIR.

Important: After receiving the COR, do not forget to obtain your Authority to Print or BIR 1906. Failure to do so will result in a ₱1,000 penalty. If the ATP expires, you will be fined ₱10,000, and failure to issue official receipts would result in a ₱21,000 fine.

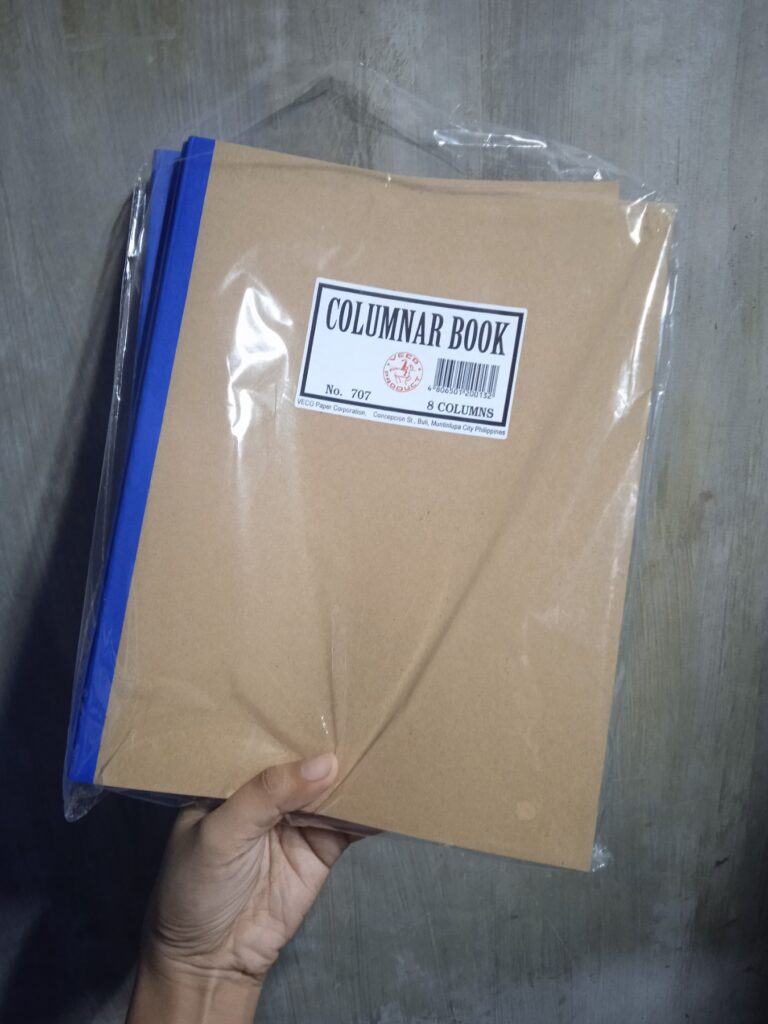

The following day, I returned (again, with an e-BIR appointment) to register my books of accounts. The RDO required me to have 4 books registered – cash receipt, cash disbursement, journal, and ledger. I filled out BIR 1905 form when registering my books. In a few minutes, they had my books stamped. Afterward, I hand over the form 1906 generated by my RDO to their accredited printer for printing. In a set of 10 booklets, I paid ₱1200.00 for the most basic and non-carbonized receipt. The receipt booklets will be printed in two weeks. So I refrained from looking for clients until I received my receipts.

Here are my official business documents: BIR 2303, or Certificate of Registration, as well as the green signage and receipts.

Attend the Seminar

The seminar will help you as a newly-registered freelancer so that you are aware of your rights, penalties, and responsibilities as a taxpayer. Attending this seminar will broaden your knowledge of accurately submitting your income tax and other types of taxes depending on your registered entity. This is not mandatory but encouraged. If you are unable to attend the seminar, you may still address your issues and obtain clarification from any officer in charge.

Nowadays, they held the seminar virtually through Zoom. Also, they sometimes post schedules about the seminar every now and then. Kindly check with your BIR RDO’s Facebook Page for announcements regarding those seminars.

Note down these important dates

- January 30 – payment of Annual Registration Fee

- April 15 – filing and payment of 1701A or Annual Income Tax Return

- May 15 – 1st Quarter filing of 1701Q

- August 15 – 2nd Quarter filing of 1701Q

- November 15 – 3rd Quarter filing of 1701Q

For other important deadlines, feel free to browse the official BIR website.

Conclusion

That’s it! It is really simple to register as a freelancer on BIR. However, that’s not the end of it. After you start your freelance business, be sure to issue official receipts and maintain your records up to date to avoid penalties. If you have any questions about my personal experience when registering as a freelancer, feel free to message me at alpha@marlenpalayad.com, via our Contact Form, through our Facebook Page, or via my Live Chat.